Your Steel Building Specialist

Steel Building Price Increases

Steel Building Price Increases

Updated December 2021 Info BelowIf you look at most any pre-engineered steel building quote, you will probably see a line that says pricing is valid for X number of days. Could be 5, 10, 15 days. You may ask yourself why the time limit on a quote?

Most people understand that steel is a commodity product which means the pricing of iron ore, carbon and the many other elements that make up steel are priced based on the current demand and which is one cause for fluctuations in the steel market. While the steel that makes up a building does not fluctuate day to day, market forecasting plays a role in the final pricing. The other big factor in steel building pricing is the demand for steel in and out of the building industry.

When the plants get orders in they typically create the permit drawings in a couple of weeks and then detail, plan, produce and ship the final product in the following 6 weeks or so. That's when demand is at a typical level. During the planning process they go ahead and buyout the steel needed for any jobs that are in house. This allows them to purchase the steel at current pricing giving them some cushion for the market swings. Again, this is how it works during times with normal demand.

As the demand increases, there are only so many jobs the plants can produce so the normal 6-8 weeks increases to 10-12, 18-20 or even longer. That of course means more steel is purchased and increased demand drives the cost of goods up. This demand not only comes from the steel building industry, but from many markets that use some of the same products such as the automotive industry.

Steel building price increases update December 9th, 2021

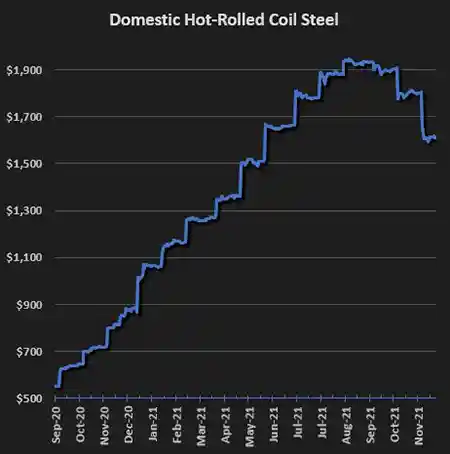

Looking at hot rolled coil steel pricing, it would appear that we have finally seen the peak with pricing beginning to settle back down. In August it hit a high of over $1,900 and is now hovering around $1,600 per tonne. Barring any major changes in the domestic and international markets, hopefully the prices will ease back down closer to what we have seen in the past.

So why isn't the price for steel buildings falling as well? In time it will follow, but for now there are still a few factors that continue to keep prices up. First is that the pricing for the coils of hot and cold rolled steel are just that, coils. They still have to be converted to all the parts and pieces that make up a steel building. First some coils have to be coated and then they have to run through the forming machinery to create panels, trim, and structural members. Obviously this is a simplified explanation as there are many steps involved as well as shipping and handling to get to the different processes. Second is how a steel building is produced. As an order goes through the process, a building gets engineered, detailed and scheduled for production. Steel for that building is purchased weeks or even months ahead of the actual process of fabrication. That means that while you see prices changing today, it could take many months for those changes to trickle down into the process. The last factor (which is certainly not the least) is the tremendous activity that has been happening in the steel building industry over the last 1-2 years. Strong demand created many orders for pre-engineered steel buildings as well as for structural steel designs. Over these last couple of years we have seen lead times of 8-10 weeks change to 20-30 weeks and sometimes even longer. Depending on our supplier we are still seeing lead times from 16 weeks up to around 30. Until all of these orders are completed and delivered, pricing from the plants will continue to adjust according to supply and demand. Hopefully in 6-9 months we will start seeing some relief on lead times which may lead to some favorable pricing adjustments.

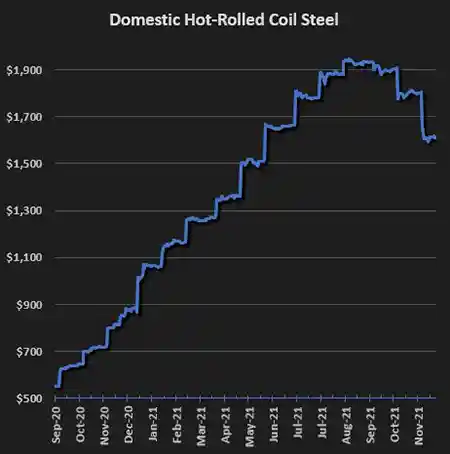

Steel building price increases update August 9th, 2021

Steel building price increases update July 5th, 2021

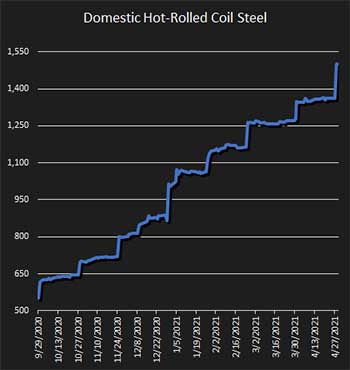

Yet again, the industry continues to push higher in steel pricing. Domestic hot rolled coil steel took another jump in June to nearly $1,800. That is up over 200% compared to the closing price of $550 back in September 2020. As you can imagine that translates into a considerable increase in any industry utilizing steel.

As steel demand exceeds production, we expect this trend to continue. Not only does the demand drive pricing, but it has also created shortages that make orders difficult to fill as material lead times increase and some go into allocation. These lead times and allocations affect every aspect of our industry much as it does for all industries competing for the same coils of hot rolled steel, cold rolled steel and plate steel.

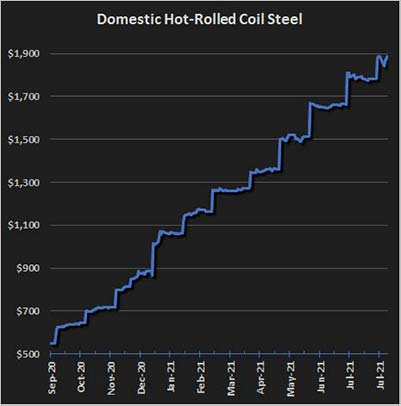

Update May 5th, 2021

Pricing on steel products such as hot rolled steel coils continue to push upward. The overall trajectory for a wide variety of steel products is still on a steady rise from where it was back in September/October of 2020. This commodity item along with many other components make up the base for products consumed in a pre-engineered steel building which gives you a good indication of where the pricing in the market is heading. Add to that an imbalance in the trucking industry leading to more loads than drivers available. Not only are the cost of goods rising, so are the costs to transport both raw materials and finished products as well.

While we thought the industry would be leveling off at this point, there seems to be no end in sight for this upward trend (at least not yet). In fact, building deliveries have been pushed out to 26-29 weeks depending on the plant location.

Price increases have yet to affect demand, so we continue on watching the steady climb and plant schedules staying full.

Update February 16th, 2021

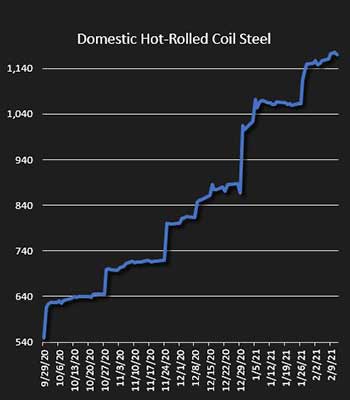

Steel commodities continue to hold strong into February. Hot-rolled coil steel continues it's push upward as do other components used in a pre-engineered steel building. Similar increases can be seen in traditional building materials as well. Strong demand and supply chain disruptions due to Covid related illness and contact tracing continue to push prices higher.

From the info the plants have shared with us, this trend shows no signs of slowing down still. Building deliveries have been pushed out to 26-30 weeks depending on the plant location.

With many customers looking to beat each price increase, the orders in house continue to fill the docket with even more orders. The plants are working hard to continue to forecast and allocate all the steel needed to complete each order.

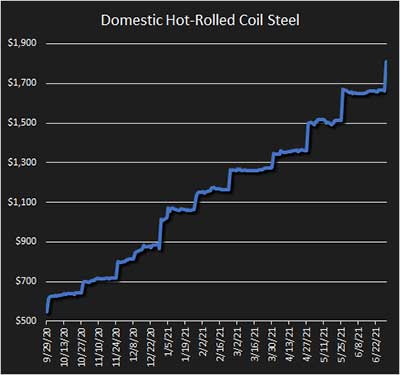

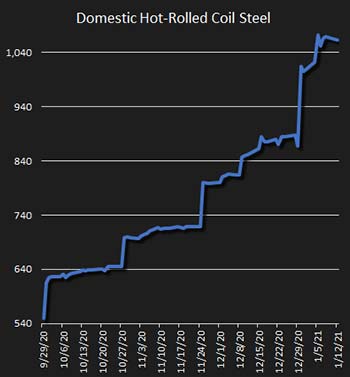

Update January 13th, 2021

As you can see from the chart, the upward trend of steel product such as hot rolled steel coils continues. The jumps we were seeing in September and October have been surpassed by the increases in November, December and January. From the info the plants have shared with us, this trend shows no signs of slowing down just yet. In fact, building deliveries have been pushed out to 16, 18 and even 20 weeks depending on the plant location.

As the orders continue, the demand continues and the supply side is having trouble keeping up. That of course means that prices should continue to rise. Even if demand slows, it will still take many months for prices to level out as the plants will need to work through completing all the orders currently in house.

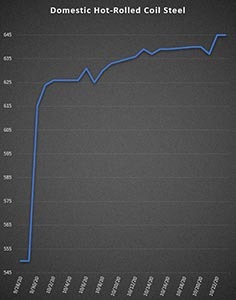

October 2020 thru January 2021

For instance, you can look up the market price for Domestic Hot-Rolled Coil Steel to see that in just the last month alone prices have increased approximately 17% from $550 to $645

So where are we now? Well, as of the week of October 26, 2020, demand has been intense. Steel building sales during late Summer and Fall of this year have been steadily increasing and show no signs of letting up. Our plants have been keeping us updated on shipping forecasts and we are now exceeding 12 weeks to deliver a building. As we saw the delivery schedule increasing we knew what would be coming next - price increases. We have a steel building price increase coming up on November 1, 2020 and have been getting information indicating more increases to come in the next month or two.

The nice thing about knowing that steel building price increases are on the horizon is that you can go ahead and order your building at the current rates to hopefully beat the next price increase.

If you are in the market for a pre-engineered steel building, call us today or fill out our quick quote form. While we don't do high pressure sales, we are happy to work diligently to get your building ordered in a timely manner if you are ready to get your building on order.